Clark Wealth Partners - Truths

Table of ContentsThe Definitive Guide for Clark Wealth PartnersNot known Details About Clark Wealth Partners Get This Report on Clark Wealth PartnersClark Wealth Partners Things To Know Before You Get ThisThe Clark Wealth Partners StatementsClark Wealth Partners Things To Know Before You Get ThisLittle Known Facts About Clark Wealth Partners.Top Guidelines Of Clark Wealth Partners

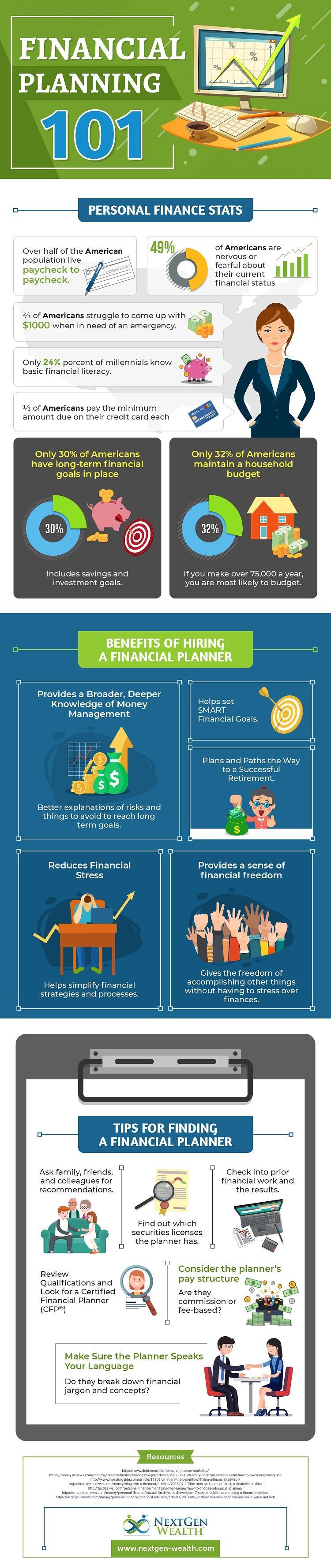

Typical reasons to consider a financial consultant are: If your financial situation has actually come to be more complicated, or you do not have self-confidence in your money-managing abilities. Saving or browsing major life occasions like marital relationship, separation, kids, inheritance, or job adjustment that might substantially impact your financial scenario. Navigating the transition from conserving for retirement to protecting riches during retirement and how to create a strong retired life revenue plan.New innovation has actually resulted in more extensive automated economic devices, like robo-advisors. It's up to you to check out and figure out the right fit - https://royal-ink-5a2.notion.site/Why-Working-With-the-Best-financial-advisors-illinois-Can-Transform-Your-Future-2b661d151d8b80fdae79fda62be2de2c. Eventually, an excellent financial expert ought to be as mindful of your investments as they are with their own, staying clear of extreme costs, saving cash on taxes, and being as transparent as feasible concerning your gains and losses

About Clark Wealth Partners

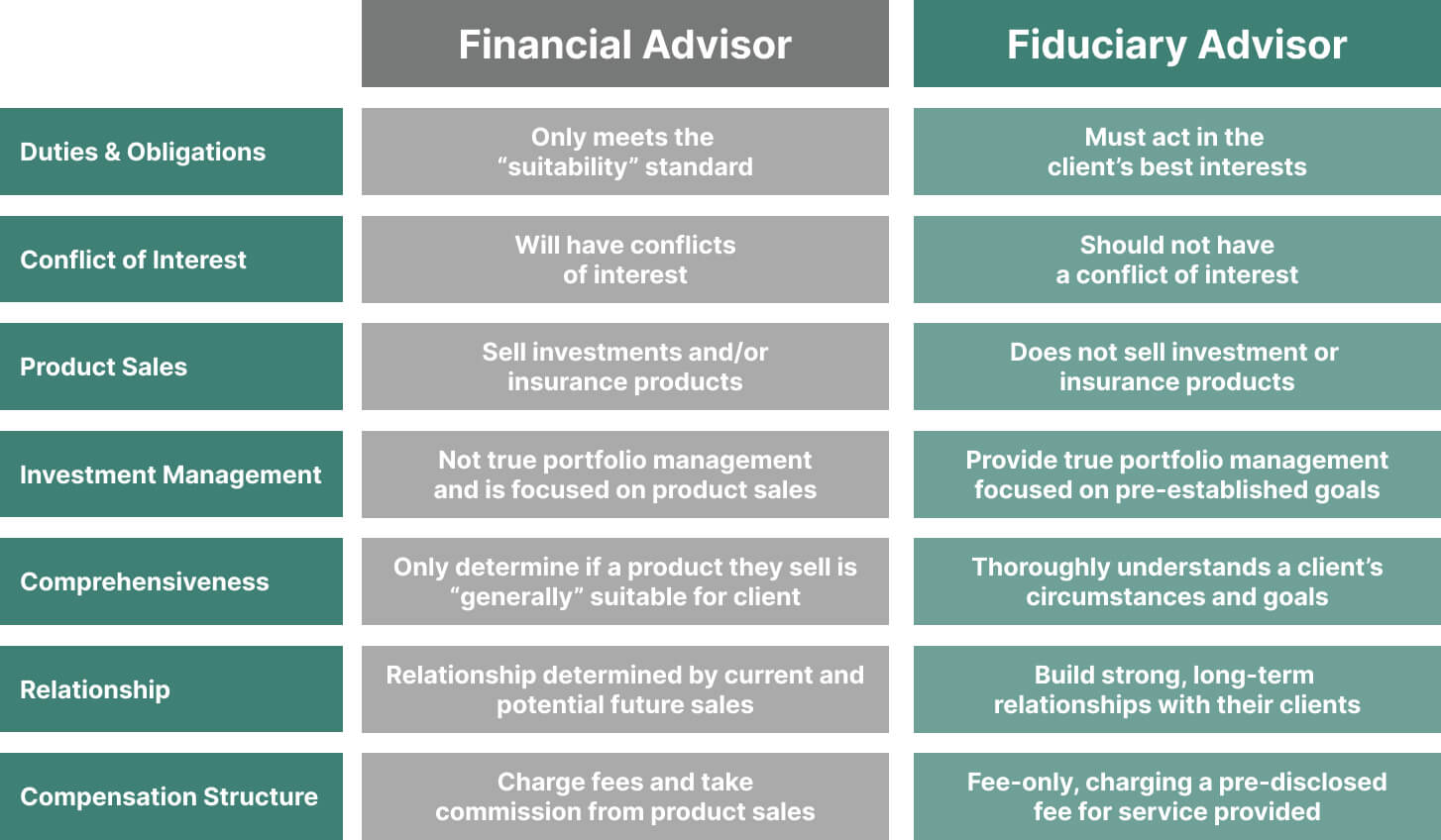

Earning a compensation on product referrals doesn't necessarily imply your fee-based expert functions versus your finest interests. But they might be a lot more likely to recommend products and solutions on which they earn a commission, which may or may not remain in your ideal passion. A fiduciary is legitimately bound to place their client's rate of interests first.

This standard permits them to make suggestions for investments and services as long as they suit their customer's goals, risk resistance, and monetary circumstance. On the other hand, fiduciary advisors are lawfully bound to act in their customer's ideal interest rather than their own.

Examine This Report on Clark Wealth Partners

ExperienceTessa reported on all points spending deep-diving right into complex monetary topics, clarifying lesser-known investment avenues, and discovering ways viewers can function the system to their advantage. As an individual financing professional in her 20s, Tessa is really familiar with the impacts time and uncertainty carry your financial investment decisions.

It was a targeted advertisement, and it functioned. Learn more Read much less.

5 Simple Techniques For Clark Wealth Partners

There's no single course to turning into one, with some people starting in banking or insurance, while others begin in bookkeeping. 1Most financial organizers begin with a bachelor's level in money, economics, accountancy, service, or a related topic. A four-year level provides a solid foundation for occupations in financial investments, budgeting, and customer service.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Common instances consist of the FINRA Collection 7 and Series 65 tests for safeties, or a state-issued insurance coverage license for offering life or medical insurance. While qualifications might not be legitimately required for all planning functions, employers and customers frequently view them as a standard of professionalism. We consider optional qualifications in the following section.

Many economic planners have 1-3 years of experience and knowledge with economic items, conformity requirements, and straight customer communication. A strong academic background is crucial, however experience shows the capability to use concept in real-world setups. Some programs combine both, allowing you to complete coursework while making monitored hours with teaching fellowships and practicums.

Our Clark Wealth Partners PDFs

Numerous enter the field after functioning in financial, audit, or insurance, and the change calls for perseverance, networking, and usually innovative qualifications. Early years can bring long hours, stress to construct a client base, and the need to constantly show your experience. Still, the occupation supplies solid long-term potential. Financial planners enjoy the possibility to function carefully with customers, overview vital life decisions, and typically attain adaptability in routines or self-employment.

Wealth managers can increase their revenues through compensations, property costs, and efficiency bonus offers. Economic supervisors look after a team of monetary coordinators and consultants, establishing department strategy, managing compliance, budgeting, and guiding internal operations. They spent much less time on the client-facing side of the sector. Almost all economic managers hold a bachelor's level, and several have an MBA or comparable academic degree.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

Optional accreditations, such as the CFP, typically need additional coursework and testing, which can prolong the timeline by a number of years. According to the Bureau of Labor Statistics, individual economic consultants earn a mean annual annual wage of $102,140, click here to read with top income earners making over $239,000.

In various other districts, there are guidelines that need them to satisfy particular requirements to utilize the economic expert or financial planner titles (financial planner in ofallon illinois). What sets some monetary consultants besides others are education and learning, training, experience and certifications. There are many designations for economic advisors. For financial coordinators, there are 3 typical designations: Licensed, Individual and Registered Financial Organizer.

The 6-Second Trick For Clark Wealth Partners

Those on wage may have an incentive to advertise the services and products their companies supply. Where to discover a monetary consultant will rely on the kind of guidance you require. These establishments have personnel who might assist you comprehend and get certain types of financial investments. For instance, term deposits, guaranteed financial investment certifications (GICs) and mutual funds.